Slippage Meaning In Forex. Slippage is the term for when the price at which your order is executed does not match the price at which at which it was requested. It occurs when the market orders could not be matched at preferred prices usually in highly volatile and fast-moving markets prone to unexpected quick turns in certain trends. This means that a large abrupt change in the quote has taken place. Types of forex trading orders Slippage is usually seen during periods of extremely high or low volatility and generally occurs during key news releases or during off market hours and occurs both in equity and forex markets and causes detrimental problems to traders.

20 Trading Risk Management Ideas Trading Stocks Investing Ideas Of Trading Stocks Inv Stock Trading Strategies Risk Management Investing Money Stock Market

20 Trading Risk Management Ideas Trading Stocks Investing Ideas Of Trading Stocks Inv Stock Trading Strategies Risk Management Investing Money Stock Market From pinterest.com

20 Trading Risk Management Ideas Trading Stocks Investing Ideas Of Trading Stocks Inv Stock Trading Strategies Risk Management Investing Money Stock Market

20 Trading Risk Management Ideas Trading Stocks Investing Ideas Of Trading Stocks Inv Stock Trading Strategies Risk Management Investing Money Stock Market From pinterest.com

Kata kata romantis malam hari Kata kata promosi pulsa Kata kata selingkuh menyentuh hati Kata kata serba salah dimata pacar

It occurs when the market orders could not be matched at preferred prices usually in highly volatile and fast-moving markets prone to unexpected quick turns in certain trends. Slippage can occur when entering or exiting your trading and is more prone to happen at certain times than others. This difference is caused by the latency between the order request and the execution. Slippage is frequent in trading at market quotations not only in Forex but also in other financial markets stock commodity. Slippage is the difference between the expected price of an asset when the trade was ordered against the actual price that the trade was executed at. Slippage trading occurs mostly when forex traders use market order for entry or exit positions.

Slippage is the difference between the expected price of an asset when the trade was ordered against the actual price that the trade was executed at.

This difference is caused by the latency between the order request and the execution. Slippage in the Forex market refers to the difference between the price you executed your trade and the final price you order was executed by your broker. Slippage occurs when the execution price of a trade is different from its requested price. Slippage is what happens when you get a different price than expected on an entry or exit from a trade. In financial trading slippage is a term that refers to the difference between a trades expected price and the actual price at which the trade is executed. Slippage inevitably happens to every trader whether they are trading stocks forex foreign exchange or futures.

How Does Forex Trading Work Infographic Forex Trading Forex Work Infographic

Source: de.pinterest.com

How Does Forex Trading Work Infographic Forex Trading Forex Work Infographic

Source: de.pinterest.com

Because it is one of the most frequently used methods of scam forex brokers. Slippage is the difference between the expected price of an asset when the trade was ordered against the actual price that the trade was executed at. There are more than 5-8 such transactions during one trading session. Slippage in forex tends to be seen in a negative light however this normal market occurrence can be a good thing for traders. Slippage occurs when the execution price of a trade is different from its requested price.

What Is Slippage Slippage In Forex Explained

Source: dailyfx.com

What Is Slippage Slippage In Forex Explained

Source: dailyfx.com

In forex and other securities there are signals given by the computer for the entry and exit for a trade. What is Slippage in FOREX and how to Avoid Trading Losses Slippage is the difference between the price specified when the trader sends the request for the trade and the price at which the actual transaction takes place when the deal is executed. Types of forex trading orders Slippage is usually seen during periods of extremely high or low volatility and generally occurs during key news releases or during off market hours and occurs both in equity and forex markets and causes detrimental problems to traders. Slippage is the difference between the expected price of an asset when the trade was ordered against the actual price that the trade was executed at. Slippage in the Forex market refers to the difference between the price you executed your trade and the final price you order was executed by your broker.

Slippage Definition Forexpedia By Babypips Com

Source: babypips.com

Slippage Definition Forexpedia By Babypips Com

Source: babypips.com

The slippage amounts to 5 points against the trader. Slippage can occur when entering or exiting your trading and is more prone to happen at certain times than others. There are more than 5-8 such transactions during one trading session. What is slippage. All active methods scalping PIP sometimes day trading often involve taking several points from each order.

The Ins And Outs Of Forex Scalping

Source: investopedia.com

The Ins And Outs Of Forex Scalping

Source: investopedia.com

Slippage trading occurs mostly when forex traders use market order for entry or exit positions. The slippage amounts to 5 points against the trader. The size of the slippage varies from one to several dozen points. A limit order is effective because it executes your trade orders at. In forex and other securities there are signals given by the computer for the entry and exit for a trade.

What Is Slippage Slippage In Forex Explained

Source: dailyfx.com

What Is Slippage Slippage In Forex Explained

Source: dailyfx.com

Slippage occurs when the execution price of a trade is different from its requested price. There are more than 5-8 such transactions during one trading session. Slippage and the Forex Market Forex slippage occurs when a market order is executed or a stop loss closes the position at a different rate than set in the order. Slippage in the Forex market refers to the difference between the price you executed your trade and the final price you order was executed by your broker. Slippage is frequent in trading at market quotations not only in Forex but also in other financial markets stock commodity.

What Is Slippage How To Avoid Slippage In Forex Trading Pips Edge

Source: pipsedge.com

What Is Slippage How To Avoid Slippage In Forex Trading Pips Edge

Source: pipsedge.com

Slippage in Forex Trading The difference between the price specified in a trade vs the actual transaction price. As we know slippage represents the difference between the expected price of a trade and the price at which the trade is executed and happens when a trader places an order but gets it executed at a different price. It occurs when the market orders could not be matched at preferred prices usually in highly volatile and fast-moving markets prone to unexpected quick turns in certain trends. Slippage is what happens when you get a different price than expected on an entry or exit from a trade. This difference is caused by the latency between the order request and the execution.

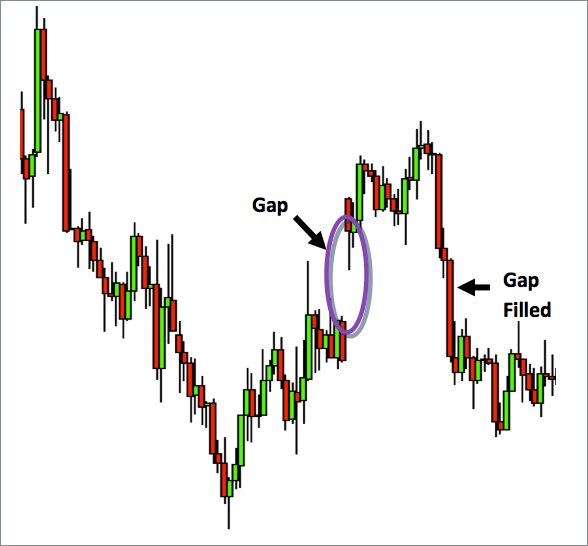

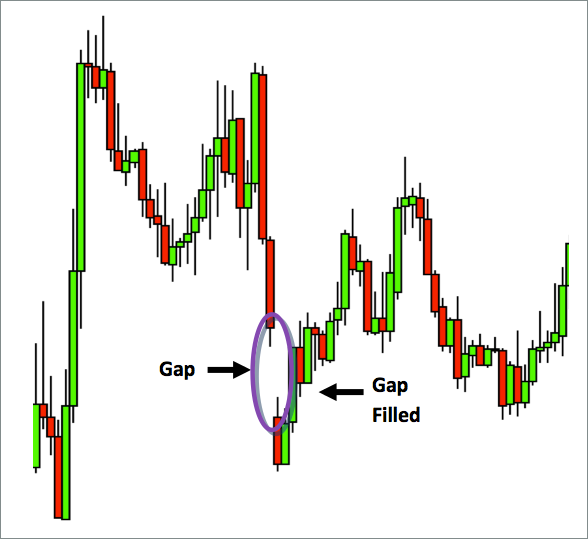

Understanding Market Gaps And Slippage Forex Com

Source: forex.com

Understanding Market Gaps And Slippage Forex Com

Source: forex.com

All active methods scalping PIP sometimes day trading often involve taking several points from each order. When forex trading orders are sent out to be filled by a. Slippage is when an order is executed at a price worse than that at which it was placed. Because it is one of the most frequently used methods of scam forex brokers. Since the forex market is so fast and liquid slippage is usually very small.

Slippage Definition Forexpedia By Babypips Com

Source: babypips.com

Slippage Definition Forexpedia By Babypips Com

Source: babypips.com

All active methods scalping PIP sometimes day trading often involve taking several points from each order. While looking at comments about forex brokers on many forums we see complaints about slippage. When forex trading orders are sent out to be filled by a. However an important part of forex complaints is about the slippage problem. Every single item in them is incredibly important.

What Is Forex Trading And How To Do Forex Trading In India By Mohanani88 Issuu

Source: issuu.com

What Is Forex Trading And How To Do Forex Trading In India By Mohanani88 Issuu

Source: issuu.com

Slippage trading occurs mostly when forex traders use market order for entry or exit positions. However an important part of forex complaints is about the slippage problem. Slippage trading occurs mostly when forex traders use market order for entry or exit positions. When forex trading orders are sent out to be filled by a. Slippage can occur when entering or exiting your trading and is more prone to happen at certain times than others.

Forex Scalping Definition

Source: investopedia.com

Forex Scalping Definition

Source: investopedia.com

Slippage is the difference between the expected price of an asset when the trade was ordered against the actual price that the trade was executed at. When forex trading orders are sent out to be filled by a. The difference is usually caused by the latency between trade order and execution. Slippage can occur during when important news which has a significant effect on the market comes out. Types of forex trading orders Slippage is usually seen during periods of extremely high or low volatility and generally occurs during key news releases or during off market hours and occurs both in equity and forex markets and causes detrimental problems to traders.

What Are Price Gaps In Forex Trading Trading Education

Source: trading-education.com

What Are Price Gaps In Forex Trading Trading Education

Source: trading-education.com

When forex trading orders are sent out to be filled by a. At the same time one of the ways to understand whether a forex broker is scam is slippage. Since the forex market is so fast and liquid slippage is usually very small. Types of forex trading orders Slippage is usually seen during periods of extremely high or low volatility and generally occurs during key news releases or during off market hours and occurs both in equity and forex markets and causes detrimental problems to traders. Here we will examine a little more in depth as to how forex slippage occurs and how you can best manage to avoid these situations.

The Ins And Outs Of Forex Scalping

Source: investopedia.com

The Ins And Outs Of Forex Scalping

Source: investopedia.com

The size of the slippage varies from one to several dozen points. Every single item in them is incredibly important. Here we will examine a little more in depth as to how forex slippage occurs and how you can best manage to avoid these situations. In financial trading slippage is a term that refers to the difference between a trades expected price and the actual price at which the trade is executed. What is Slippage in FOREX and how to Avoid Trading Losses Slippage is the difference between the price specified when the trader sends the request for the trade and the price at which the actual transaction takes place when the deal is executed.

What Is Slippage How To Avoid Slippage In Trading Ig En

Source: ig.com

What Is Slippage How To Avoid Slippage In Trading Ig En

Source: ig.com

This difference is caused by the latency between the order request and the execution. Thus it is logical to use limit orders among other ways to stop slippage in forex trading. What is slippage. In financial trading slippage is a term that refers to the difference between a trades expected price and the actual price at which the trade is executed. Because it is one of the most frequently used methods of scam forex brokers.

What Is Slippage In Forex Securities Io

Source: securities.io

What Is Slippage In Forex Securities Io

Source: securities.io

Slippage in the Forex market refers to the difference between the price you executed your trade and the final price you order was executed by your broker. Slippage inevitably happens to every trader whether they are trading stocks forex foreign exchange or futures. When and Why Does Slippage Occur. This difference is caused by the latency between the order request and the execution. It occurs when the market moves against your trade and in the time it takes for your broker to process the order the original price set is no longer available.

Understanding Market Gaps And Slippage Forex Com

Source: forex.com

Understanding Market Gaps And Slippage Forex Com

Source: forex.com

The difference is usually caused by the latency between trade order and execution. When and Why Does Slippage Occur. There are more than 5-8 such transactions during one trading session. It occurs when the market orders could not be matched at preferred prices usually in highly volatile and fast-moving markets prone to unexpected quick turns in certain trends. This difference is caused by the latency between the order request and the execution.

What Is Slippage Slippage In Forex Explained

Source: dailyfx.com

What Is Slippage Slippage In Forex Explained

Source: dailyfx.com

Thus it is logical to use limit orders among other ways to stop slippage in forex trading. This means that a large abrupt change in the quote has taken place. Slippage trading occurs mostly when forex traders use market order for entry or exit positions. All active methods scalping PIP sometimes day trading often involve taking several points from each order. As we know slippage represents the difference between the expected price of a trade and the price at which the trade is executed and happens when a trader places an order but gets it executed at a different price.

What Does A Forex Spread Tell Traders

Source: dailyfx.com

What Does A Forex Spread Tell Traders

Source: dailyfx.com

What is Slippage in FOREX and how to Avoid Trading Losses Slippage is the difference between the price specified when the trader sends the request for the trade and the price at which the actual transaction takes place when the deal is executed. But there are moments in Forex when the execution of the order is carried out. Slippage is frequent in trading at market quotations not only in Forex but also in other financial markets stock commodity. Slippage in Forex Trading The difference between the price specified in a trade vs the actual transaction price. In financial trading slippage is a term that refers to the difference between a trades expected price and the actual price at which the trade is executed.

Best Forex Robot Ea Forex Trading Trending

Source: pinterest.com

Best Forex Robot Ea Forex Trading Trending

Source: pinterest.com

It occurs when the market moves against your trade and in the time it takes for your broker to process the order the original price set is no longer available. Slippage inevitably happens to every trader whether they are trading stocks forex foreign exchange or futures. But there are moments in Forex when the execution of the order is carried out. Slippage in Forex Trading The difference between the price specified in a trade vs the actual transaction price. Slippage and the Forex Market Forex slippage occurs when a market order is executed or a stop loss closes the position at a different rate than set in the order.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title slippage meaning in forex by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.